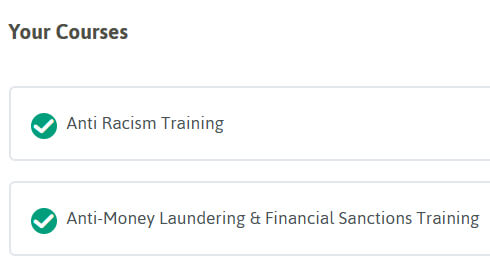

Anti-Money Laundering & Financial Sanctions Training

Already enrolled on the course? Please login to access.

Who is this training designed for?

- Members of the Bar practising from Chambers

- First and Second Six Month pupils

- Senior Chambers support staff

This course offers an overview of the law and procedure concerning the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (“MLR”) as well as the UK sanctions regime. Lawyers are at risk of unwittingly becoming involved in money laundering and/or the breach of sanctions. Lawyers who fall into such misconduct are at risk of criminal or regulatory proceedings with severe consequences.

This training is mostly applicable to lawyers, but will also be a useful learning tool for staff occupying senior positions in Chambers.

About the Authors

Jake Taylor 2012 call

Jake is leading counsel appearing in heavyweight and complex criminal cases, particularly those matters that have an international dimension. He also advises on sanctions, cross-border investigations, inquests and extradition requests.

He was previously appointed by the Cayman Islands government to lead investigations and prosecutions of international corruption and cross-border money laundering in a leading international financial centre, and has previously advised the Foreign Commonwealth and Development Office on the Russian sanctions regime.

Jake combines practice with his judicial role sitting as an Assistant Coroner at the Westminster Coroner’s Court hearing inquests and as a member of the adjunct staff on the Transnational and International Criminal Law course at the University of Amsterdam.

Christopher Sykes 2015 call

Christopher specialises in financial crime, confiscation, and professional discipline and is Panel C counsel for the Serious Fraud Office, and also acts for authorities and individuals in civil and criminal matters concerning the proceeds of crime.

He has particular expertise in matters concerning the freezing, detention and forfeiture of cash, crypto assets and bank accounts. Christopher represents both prosecution and defence in criminal proceedings arising from fraud and financial crime and has acted as junior counsel and disclosure counsel in complex FCA prosecutions.

Christopher regularly appears for the Council for Licensed Conveyancers in proceedings concerning breach of money laundering regulations.